His Highly Complex Bond Option Position Helped Get Me Fired From First American, But It Was Not His Fault

Don Morton, the second futures brokerage account I ever opened as a full-service futures broker, passed away on Monday, December 2, 2024, at the age of 89. Don was a brilliant options trader who served as the executive director of the Tennessee Legislature's Fiscal Review Committee. He was also a U.S. Army veteran of the Korean War and a certified public accountant.

I met Don when I worked for First American Discount, where he was a customer at Table 3. Don traded options spreads, primarily on 30-year Treasury bond options. I don’t recall exactly when his account was transferred to me after I was promoted to a new trading desk for high-risk customers, but he was part of my equity run. This included large, active day traders, traders from the Hume SuperInvestor File, a German introducing broker with numerous sub-accounts, and other high-risk traders.

Don’s highly complex options position actually played a role in my being fired from First American. Another key figure was Gil Leistner, who led an options market-making group at Rosenthal. Gil also played a pivotal role in my career, teaching me and a select group of First American colleagues about the intricacies of options trading.

The week before the 1987 stock market crash, Bill Mallers, Sr. shouted my name across the trading room midday on Wednesday. He called me over to my old trading desk, number 3, and informed me that the Dow was down 200 points. He mentioned an account holding 80 S&P 500 option straddles that was losing money, on margin call, and said the client could not be reached by telephone. Mallers had concluded that the new head of the desk, my former number two, was not up to the job.

I sat down at the desk, reviewed the equity run, and checked the price of the S&P 500 futures. At that time, deltas weren’t included on the equity runs provided by GMI, nor were they available on the quote screens. While we had last trade prices for options, they were often grossly outdated.

I had to extrapolate the deltas manually by analyzing the market and the distance of the account’s strike prices relative to the market. From there, I calculated a delta quotient for each position. I then summed up all the delta quotients, both long and short, to determine the net delta position. Finally, I multiplied that net delta by the change in the underlying market to assess the overall impact.

After completing the calculations, I determined that the account was actually making about $10,000 that day and was not on margin call. The customer had sold the straddles in August, and although the market rallied in the fall, he consistently met all margin calls for his million-dollar account. When the straddles were sold, the market was positioned in the middle of the straddle. By October, the market had risen significantly above the straddle, which the customer had margined up to maintain. However, as the market fell, it landed right back in the middle of the original straddle position.

When I explained this to Bill Mallers, Sr., he decided that I should take over handling the account in the future.

By Friday, the stock market's decline had intensified, and the S&P futures were dropping sharply, putting the account in serious jeopardy. That afternoon, I was discussing potential next steps with the client when Bill Mallers, Jr. decided that the situation's gravity required the Mallers family's direct involvement. At that point, I stepped aside, and Bill, Jr. took over the conversation with the client at 3 p.m. on the Friday before the infamous 1987 stock market crash.

The client, located in Arizona, explained that he couldn’t reach the bank before 3:15 p.m. to wire the required funds, as per our standard practice for wire transfers. Instead, he asked if we would accept a $1 million check sent overnight via FedEx. Bill Mallers, Jr. made the critical decision to accept the check and personally came into the office on Saturday to ensure its arrival and handling.

On Monday morning, as the stock market opened sharply lower, the $1 million check turned out to be no good. We had no choice but to liquidate the client’s position, resulting in a $1.5 million loss. First American eventually pursued legal action against the client to recover the funds, reportedly spending $1.5 million in legal fees before ultimately abandoning the case, or so I was told.

It was on that tumultuous Friday that Don Morton entered the story. Earlier in the day, Gil Leistner had observed irregular and chaotic volatilities in the bond option pit at the CBOT, reminiscent of the turmoil in the S&P 500 earlier in the week. Leistner relayed his observations to Les Rosenthal, who then informed Bill Mallers, Sr. I would only learn about this chain of events years later during an interview with Leistner for the Open Outcry Traders History Project—though that particular detail was never included in the final interview.

Bill Mallers, Sr. shared the information about the irregular volatilities with me because Don Morton was holding 10 to 15 equity run pages of bond and note option spread positions. I suggested to Bill, Sr., "The first thing to do is call the customer, explain the market conditions, and ask what impact he thinks this might have on his position." Bill, Sr. thought this was the most ridiculous idea he had ever heard and that I had completely lost my judgment. He promptly pulled me off the trading desk and sent me to sit in the smoking lounge.

The smoking lounge, notorious for being a place where even plants couldn't survive, was hardly an ideal setting for me to cool down after five days of adrenaline-fueled work in the high-stakes world of listed derivatives. Sitting idle in that stifling environment, surrounded by the lingering haze and inactivity, was unbearable for someone accustomed to the constant rush of the trading desk.

Frustrated and unable to stay idle, I finally told them, "If you’re not going to let me work, I’m going home." When I returned on Monday, Bill, Jr. called me into his office and fired me. I asked to speak with Bill, Sr., and was told he would be in at 11. I returned at the appointed time, and when I spoke to him, he simply said, “Call me in a week.”

When I called Bill, Sr. a week later, he told me to come back in. When I returned, I found that I was no longer assigned to the high-risk desk. Instead, I was placed on what we called the "cheap ass" desk, handling accounts that opened with less than $5,000 and were charged higher commissions. It was clear that the writing was on the wall for my time at First American Discount Corporation.

After a brief sojourn as an off-the-floor trader with Joe Corona and Bruce Lawrence's Meltdown Trading Group and a stint as a member of the MidAmerica Commodity Exchange, I made my way back to the brokerage business. I joined Gerald Commodities as a full-service broker, eager to apply my experience and rebuild my career in the brokerage side of the trading world.

When I left FADC, it was to become a trader, not a broker, and I didn’t take any customer lists or contact information with me. However, some of my favorite FADC clients’ telephone numbers were imprinted in my memory. I called them to let them know I was now a full-service broker, ensuring they were aware of my new role and availability.

Don Morton was the second customer to open an account with me at Gerald. Interestingly, the Friday when Bill, Sr. shared his critical thoughts about customers turned out to be Don’s best trading day ever. Don was long volatility through bond and note spreads, including butterflies, and capitalized on the chaotic market conditions.

Don remained a loyal client throughout my brokerage career, transitioning with me as I evolved professionally. He became a managed futures customer of Jon Matte and Defender Capital Management when I began marketing Defender to clients. Don continued with the program even when I started trading the Defender system at John J. Lothian & Company, Inc. Ultimately, he closed all his accounts to focus on providing for his grandchildren, a testament to his priorities and thoughtful planning.

One of my favorite stories about Don involves the opening of his account at Gerald. Normally, customers were required to fill out account forms detailing their assets, income, and trading experience, after which compliance officers would speak to them to ensure they understood the risks of futures trading. However, this step wasn’t necessary for Don. When I asked why, the compliance officer explained that Don’s account paperwork was so meticulously filled out—with his income and net worth listed down to the penny—it was clear this CPA, who worked for the Tennessee Legislative Fiscal Review Committee, had a comprehensive understanding of the risks involved. His precision and professionalism left a lasting impression.

Don and I kept in touch over the years, primarily through Facebook. He would occasionally comment on my posts, and I made a point of wishing him a happy birthday every year. It was a simple yet meaningful way to stay connected. Rest in peace, my friend.

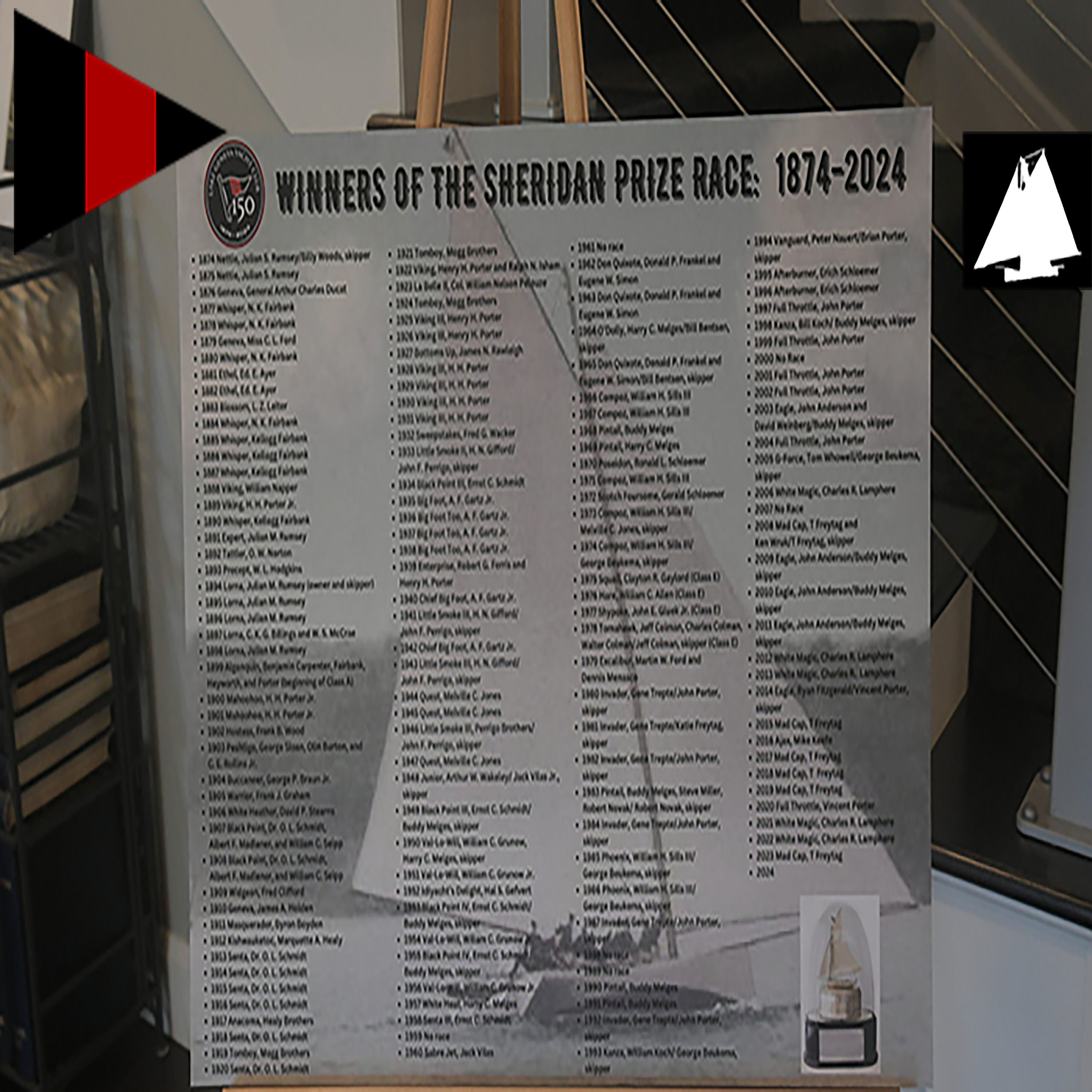

When my son Tim was ten, he came home from school one day and told us at the dinner table about his day touring...

The intertwined history of the Lake Geneva Yacht Club, the Chicago Board of Trade, and the City of Chicago traces back to the 19th...